The Role Of Personal Loan Apps In Financial Emergencies

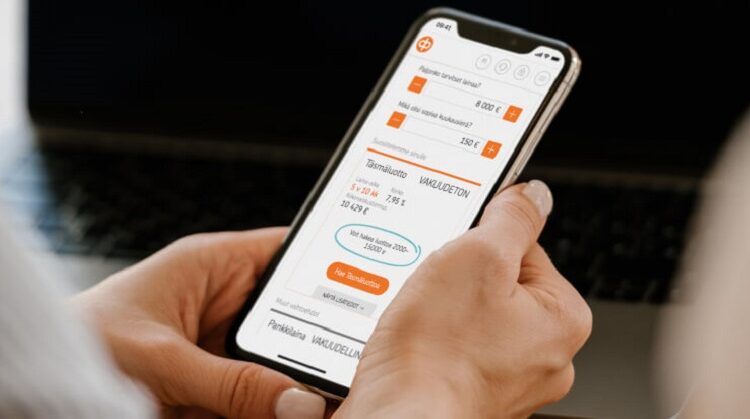

In today’s world, our basic needs have increased from food, clothes and shelter to include things like education, health, utility bills, subscriptions, eating out, maintaining cars, etc. Because of this, a financial emergency can strike at any moment, leaving individuals desperate for quick and reliable solutions to cover urgent expenses. Personal loan apps are a popular and convenient option for individuals facing such situations. You can easily get health, education and even shopping loans by following a few easy steps.

Personal loan apps offer a lifeline to help individuals bridge the gap between their financial and available resources, enabling them to manage emergencies easily. This article will explore how personal online loan apps have become the best way to save us in times of financial crisis.

- Transparent terms and conditions

Personal loan apps usually prioritize transparency by presenting boulevards with clear and concise terms and conditions. Before accepting the loan offer, borrowers can review the interest rates, repayment tenures, and associated fees. This transparency empowers borrowers to make the right financial decisions and choose loan options that suit their financial circumstances.

By avoiding hidden charges and ambiguous contractual terms, individuals can effectively manage their repayment plans without falling into a cycle of debt.

- Flexibility in loan amounts

Financial emergencies can vary greatly in terms of the amount required. Personal loan apps offer a range of loan amounts to accommodate different needs. Borrowers can apply for smaller flexi loan amounts to cover minor emergencies or larger sums for significant financial crises.

This flexibility allows individuals to customize their borrowing to match the precise magnitude of their emergency, preventing unnecessary over-borrowing and additional financial strain.

- Accessibility

One of the key advantages of personal loan apps is their accessibility to a broader population. Traditional financial institutions often have strict eligibility criteria that can exclude many individuals, especially those with a limited credit history or unconventional income sources. On the other hand, personal loan apps have evolved to solve a wider audience, whether they need a travel loan or a car loan.

They leverage alternative data points and technology-driven assessment models to make lending decisions. This inclusivity shows that people who might otherwise struggle to obtain loans from traditional sources can access the funds they need during emergencies.

- Minimal impact on credit score

Traditionally applying for loans involves a hard credit enquiry which can impact the borrower’s credit score. Personal loan apps often offer pre-qualification features that allow users to check their eligibility without affecting their credit scores.

This enables borrowers to explore their options without fearing negatively impacting their creditworthiness. A formal credit check will be conducted only once they decide to proceed with a specific loan offer.

Personal loan apps have proven to be a reliable and efficient solution for obtaining immediate funds in financial emergencies. Their speed, convenience, accessibility, transparency and flexibility make them a valuable tool for individuals seeking to navigate unexpected financial challenges without incurring substantial costs or delays. However, it is essential to approach these apps with caution and responsibility. Borrowers should carefully assess their repayment capabilities and only borrow what they can comfortably repair to avoid falling into a debt trap.

Comments are closed.